Cash Flow: the Number One Challenge for Growing Small Businesses

Regardless of company size, cash flow and cash will always be among the most critical elements to keep an eye on for any company trying to grow. More small businesses get into trouble due to cash than any other reason.

Leaders are often surprised that they have challenges with cash when their business shows a good profit, but business growth requires a lot of cash.

Here are the four most common areas that impact cash flow and surprise leaders.

- Account receivables – As the company gets more customers and bigger deals, some companies will not pay as fast as planned and some will ask for longer credit terms.

- Inventories – In order to keep up with the demand, you have to invest ahead of time to ensure customers receive their product/service in a reasonable time.

- Investments – Often you need to invest in areas like people, systems, and processes to be able to deliver at a larger scale than before.

- Re-work – As the company grows, it is harder to keep the quality in the products & solutions leading to re-work, re-calls, fixes etc.

How to check if you may be running into cash constraints

There are several ways of looking at cash flow, but we have found looking at weekly or monthly cash flow reports (cash coming in and cash going out) over a 6–12-month period is critical. If you use reports, make sure you test your assumptions that the incoming cash will be delayed, the outgoing cash will be higher, and that unplanned events will arise that will lead to increased costs.

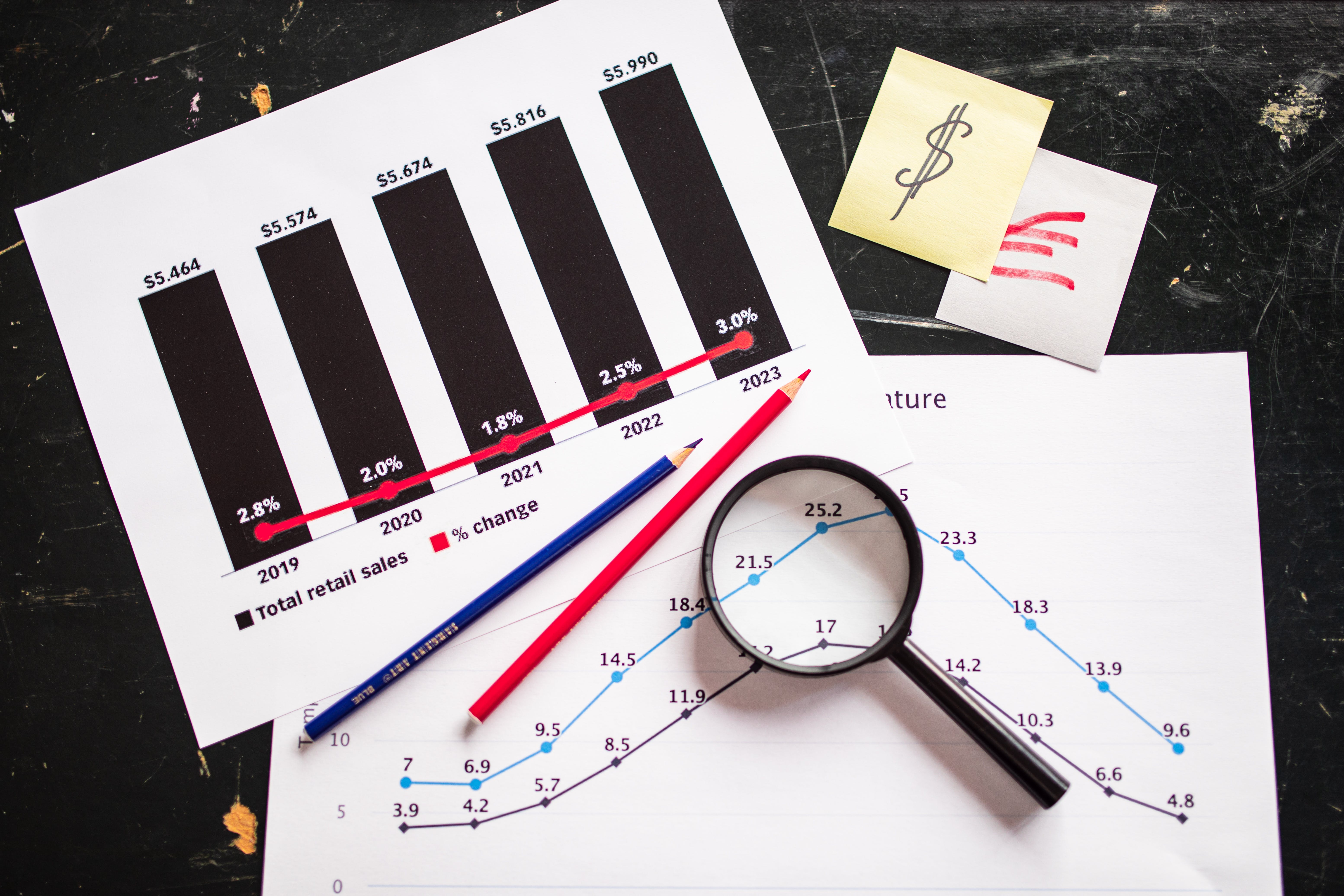

A way to find out about cash flow is to compare the balance sheets between periods (that is really how you generate a cash-flow statement) and see if they are percentage-wise growing faster than revenues. For example:

| Cash Flow Area | Quarter 1 | Quarter 2 | Change |

| Revenue | $2M |

$2.4M |

20% growth |

| Accounts Receivable | $700K | $1M | 42% growth |

Your average collection days went from 31 to 37 days just a 6 or 7-day difference. But, it means you now have $200K less in cash for a week than you planned and it landed in your payroll week.

Why do cash constraints often happen to small businesses?

As you grow, you normally get bigger customers or larger deals. Bigger customers or larger deals often require longer credit terms. It could also be that early on you knew your customers better but now as you grow, you are getting more clients and some of them don’t pay when planned.

Sometimes it can be difficult to know where cash gets tied up in a business that is growing. Often, we hear problem areas like supply delay, re-work, contract negotiations, errors in invoices, and many more. We have found that stapling yourself to an order, meaning following an order from when the customer says “yes” until the time the customer’s money is in your account is a helpful process to walk through. It is useful to take this order journey from time to time to find where delays are happening, and your cash is tied up.

- Associate Development (1)

- Business News (1)

- Business Planning (3)

- Business Resources (2)

- Communication (3)

- Decision-Making (3)

- E.I. (1)

- Finance & Accounting (1)

- High-Performing Teams (1)

- Inspiration (1)

- Management (3)

- Operations (1)

- People Skills (1)

- Self-Awareness (2)

- Small Business (3)

- Strategy (3)

- Business Growth (6)

- Finance (3)

- From 50 to 500 (3)

- General (2)

- Leadership (8)

Too Fast or Too Slow – Growth Can Still Cause the Same Cash-Flow Problem

Over the past few months, I’ve come across two companies facing serious cash-flow challenges but for completely opposite reasons. As I’ve discussed in previous blogs, cash flow is one of the most common challenges for growing companies. When you read the cases you may think they have cash issues because they are fairly new and small in size. However, in both of these examples the companies have been around for a while and both are in the hundreds with regards to number of employees.

Strategic Thinking in Your Decision Making

Businesspeople in all sizes of growing companies, routinely encounter tough decisions, challenging problems, and complicated situations. In an ideal world, leaders could rely on highly structured frameworks supported by rich datasets to point them toward great choices.

Beyond a Feeling: Emotional Intelligence Is Not the Holy Grail of Assessment

Emotional intelligence (EI) is a term thrown around often, especially in professional development. We’re told that those with high EI are better leaders, better communicators, and, overall, more successful. But is there actual science behind the hype?

10 Tips to Scaling a Small/Midsized Business

Hardly anyone focuses on the challenges you have as a leader of a small business that is established and growing. It really doesn’t matter if you are a leader with around 20 employees and growing or 100 employees and growing. After working with tens of thousands of leaders over the last 25 years, research, and my own experience growing a business to around $100M, I have these 10 tips for scaling your small to midsized business.